November 17, 2023

Author: Srinivas Abhilash

6 min read

Introduction

With prices soaring high on everything from groceries to gas, it’s hard not to notice the pinch in your pocket. As prices go up, the value of our hard-earned money goes down. This is what inflation does—it silently chips away at the purchasing power of our cash while we’re focused on managing higher expenses. Inflation essentially steals the value from our wallets.

Investing helps beat inflation by growing your money. “When you invest, you buy a day that you don’t have to work.” This quote encapsulates the essence of investing, signifying that through strategic investments, you secure future financial freedom, allowing your money to work for you and potentially generate income without requiring active participation in work. By investing, we give our money a job to earn more money and this is what makes it surpass inflation and beat it strongly.

As inflation quietly erodes the value of your money over time, investments in real estate have shown remarkable resilience, acting as a robust counterforce. Real estate stands out as a secure and reliable avenue for wealth growth. Historically, it has consistently outperformed inflation. While your savings might falter against increasing prices, real estate keeps pace and frequently exceeds the effects of inflation. It’s not solely about the property’s appreciation; it’s also the steady income it generates, aligning itself with and often surpassing the impact of inflation.

Real Estate in India

In India, real estate has generally surpassed inflation due to rapid urbanization, limited land supply in densely populated areas, rising housing demand from a growing population, and periods of robust economic growth. Additionally, it’s a popular investment choice offering high returns and is often considered a hedge against inflation.

Government policies, infrastructure development, and the aspiration for better housing have further fueled real estate appreciation. However, market cycles, regional variations, regulatory changes, and economic fluctuations can influence real estate prices despite their historical tendency to outpace inflation.

Real Estate, an Ever-growing Asset

Real estate is an ever-growing asset, consistently appreciating despite market changes. It shields against inflation, making it a stable investment for individuals and institutions seeking long-term wealth. It acts as a reliable hedge, ensuring continual growth and stability. Strategic planning and diversification across segments enhance its perpetual expansion within investment portfolios. Let’s have a look at the comparison between real estate types.

| Farmland | Apartment/Flat |

| Pros: | Pros: |

| – Appreciation Potential | – Steady rental income |

| – Income from leasing or farming operations | – Potential for property appreciation |

| – Diversification within an investment portfolio | – Liquidity for selling |

| – Tax benefits | – Professional management options |

| Cons: | Cons: |

| – Less liquidity | – Market sensitivity |

| – Management and maintenance required | – Maintenance costs |

| – Market dependency | – Regulatory factors |

| – Susceptible to risks (weather, regulations) | – Vacancy risk |

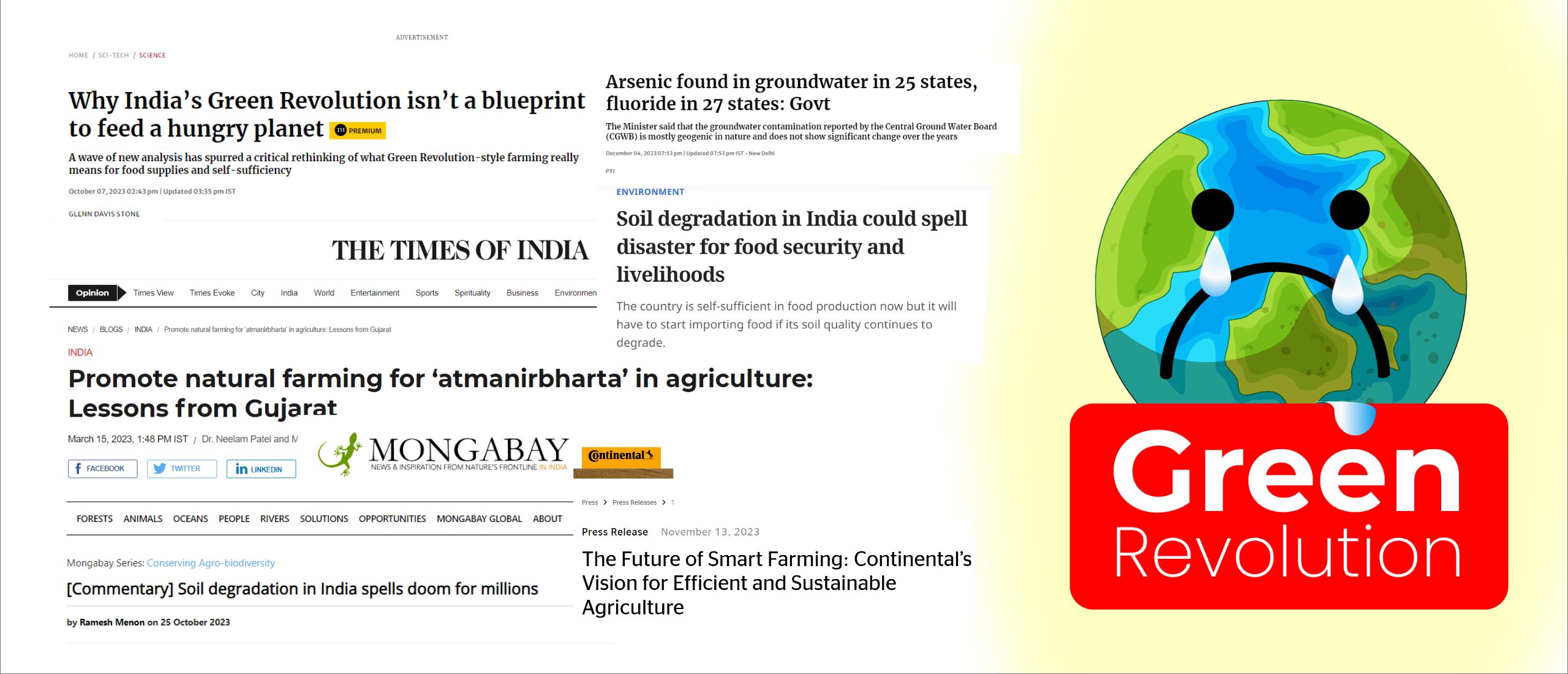

When exploring investment options, farmland stands out for its substantial potential to appreciate and compound in value over time. It tends to experience significant appreciation, especially in regions undergoing urban expansion, infrastructure growth, industrial development, or heightened agricultural demand.

Farmlands on the outskirts of rapidly expanding cities like Bangalore offer more affordable pricing compared to the steep initial costs associated with purchasing a flat. Considering construction depreciation, flats pose additional cost factors to be mindful of.

Investors who already possess a portfolio of flats and apartments within city limits, generating consistent rental income, should prioritize diversification over acquiring additional rental properties. As the saying goes, it’s wise not to keep all your eggs in one basket.

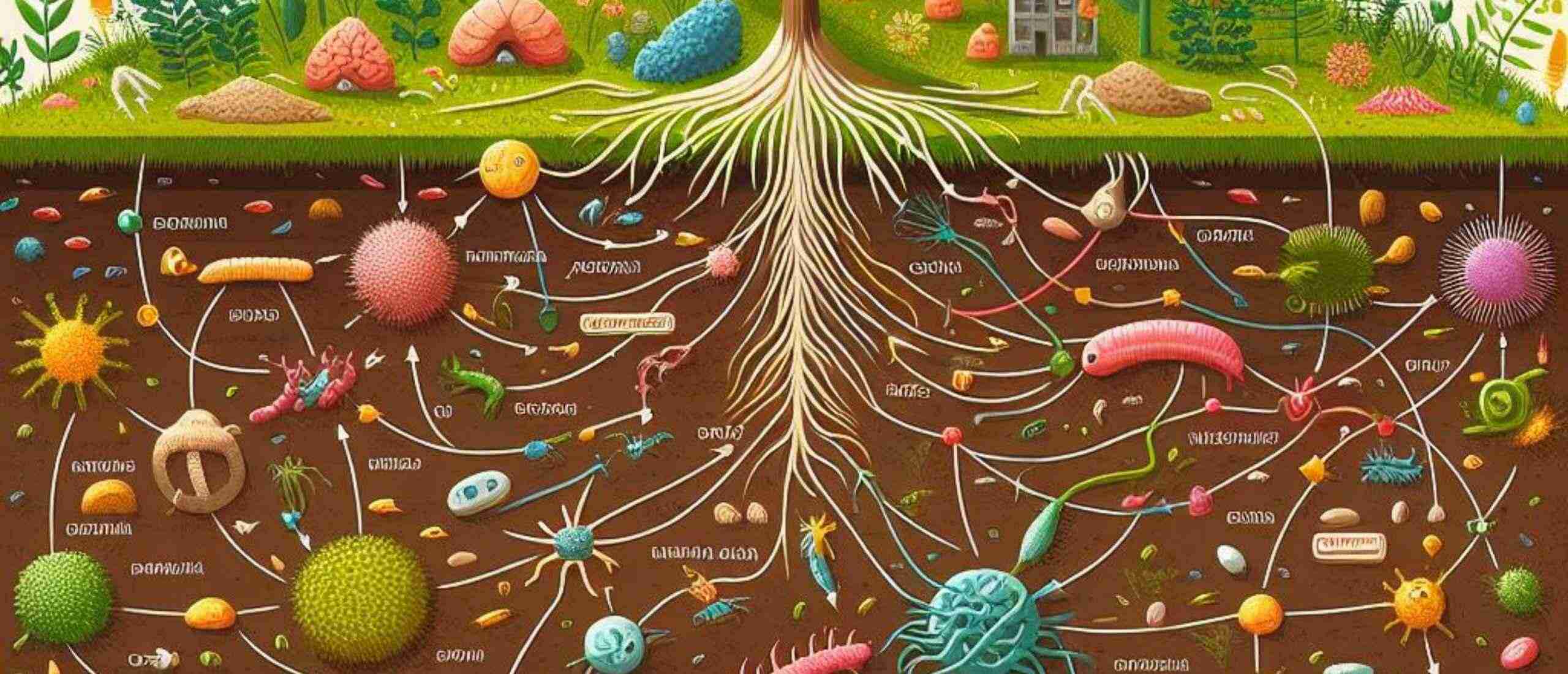

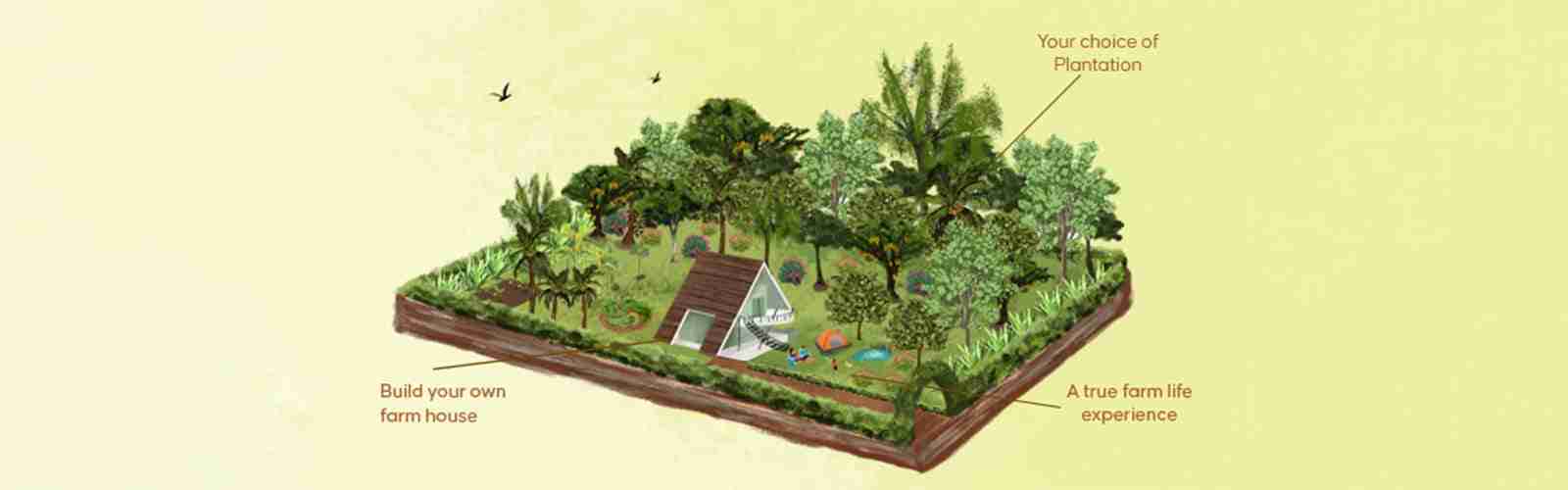

For such investors, considering farmlands, especially managed ones, offers an appealing option for diversification. Managed farmlands commonly utilize sustainable farming methods, improving soil and water quality over time. The value of farmland relies on fertile soil, its capacity to grow crops with minimal maintenance, ample groundwater, and mature trees. For instance, a flourishing mango or coconut orchard with quality soil and abundant water sources commands higher prices.

Investing in managed farmlands with sustainable practices boosts soil quality and biodiversity. Perfect for urban dwellers lacking time, skill, and expertise, these farmlands appreciate consistently, becoming valuable assets.

Hosachiguru Managed Farmlands – Defying Inflation

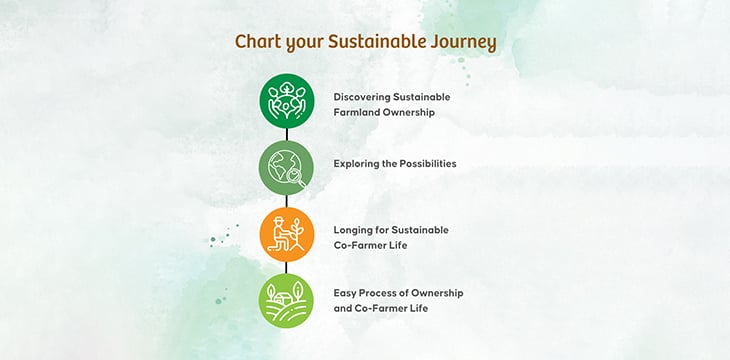

An ever-growing asset not only ensures price appreciation for the co-farmer but also fosters a holistic environment. Through Hosachiguru-managed farmlands, a holistic life approach is cultivated, manifesting growth across various aspects such as health, wealth, mental peace, financial prosperity, etc. It serves as an asset that facilitates personal growth in all spheres of life.

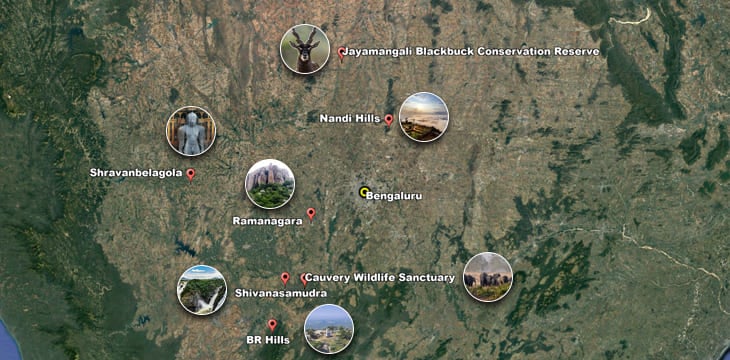

- First and foremost, in real estate, location is paramount. All Hosachiguru-managed farmlands are strategically located near growing towns, cities, national and state highways, industrial hubs, and tech parks, ensuring high land appreciation and leading to building wealth over time.

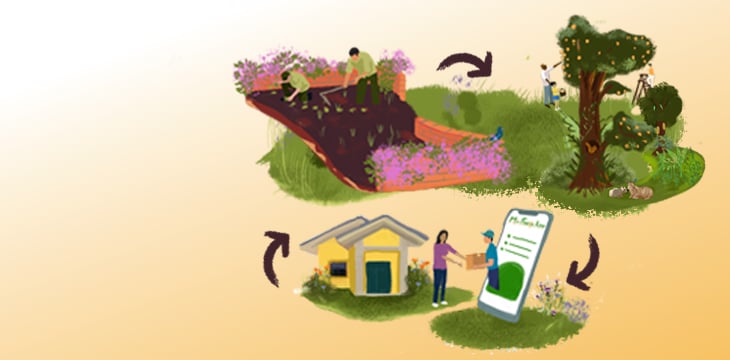

- Hosachiguru-managed farmlands utilize regenerative farming methods based on permaculture ethics. These practices interconnect land and water management, pest control, and the creation of diverse food forests. The goal is to boost biodiversity, soil fertility, and groundwater levels while minimizing external inputs. This approach ensures year-round food production for plot owners with minimal input costs. By improving land fertility and water quality, these practices gradually increase the land’s value, effectively combating inflation.

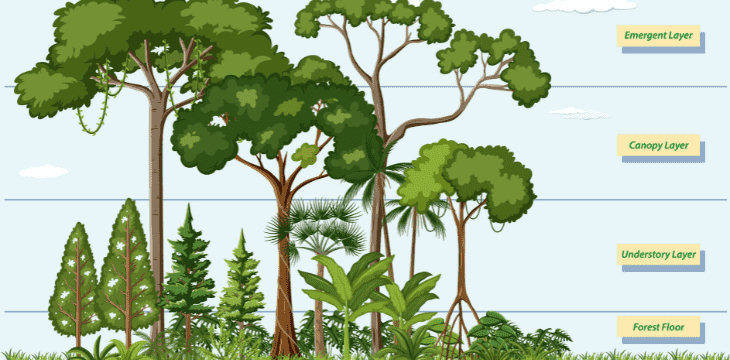

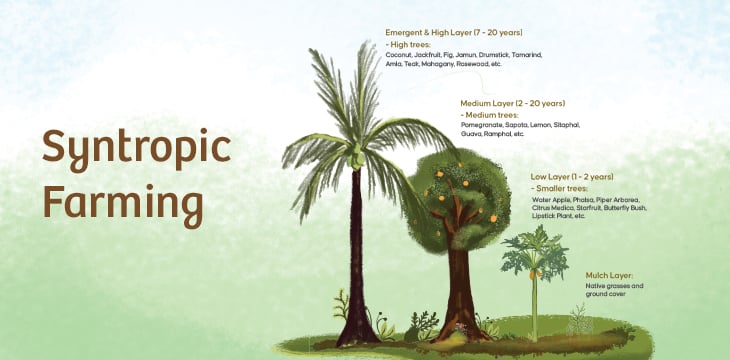

- At Hosachiguru-managed farmlands, food forests thrive with diverse plants such as fruit trees, shrubs, herbs, and climbers, resembling natural forests. These multi-layered forests offer an array of fruits year-round: tall trees (canopy), smaller trees and shrubs (understory), herbs, ground covers, and climbers form the layers. Within 2-3 years, these mature food forests yield an abundance of organic produce—fruits, nuts, vegetables, and herbs—ensuring a consistent supply. As a co-farmer at Hosachiguru, you’re more than a consumer; you’re a cultivator, nurturing pure nourishment through various fruits, herbs, flowers, and veggies. These Permaculture-rooted food forests not only offer sustenance but also empower and heal, fostering health and happiness for the co-farmers and their families at Hosachiguru

- Food grown using Regenerative agriculture is rich in nutrition, providing essential macro and micronutrients for optimal health. When individuals consume fruits and vegetables cultivated through regenerative practices, it accelerates cell repair and rejuvenation, contrasting sharply with chemically grown industrialized food. This dietary choice promotes overall well-being, leading to fewer doctor visits and reduced hospital bills, particularly for co-farmers who have invested in Hosachiguru-managed farmlands. In today’s world, families are just one hospital bill away from poverty; by prioritizing nutritious food, we fundamentally invest in our longevity, mitigating the risks of medical expenses and defying inflation.

Conclusion

Inflation’s impact stretches far beyond our finances; it ripples into every corner of our holistic well-being, affecting our physical, mental, spiritual, and financial health. Investing in managed farmlands isn’t just a financial decision; it’s a step towards safeguarding a balanced and thriving life. As Mr. Warren Buffett famously said, ‘Inflation is like toothpaste; once it’s out of the tube, it’s hard to get it back in.’ Take charge now and invest in Hosachiguru-managed farmlands to not only beat inflation but to nurture a life of holistic wellness and prosperity.